For millions of Americans saving for retirement, managing a 401(k) account with Fidelity Investments is a key part of their financial planning. Fidelity is one of the largest and most trusted providers of retirement accounts, including employer-sponsored 401(k) plans. Whether you are just starting to contribute to a 401(k), need to check your balance, want to make changes to your investment allocations, or have questions about rollovers, knowing how to contact Fidelity is essential. Having the right phone number for Fidelity 401k support ensures that you can reach help when you need it, especially when navigating complex retirement questions or handling time-sensitive account matters.

How to Contact Fidelity for 401(k) Support

Fidelity 401(k) Phone Number

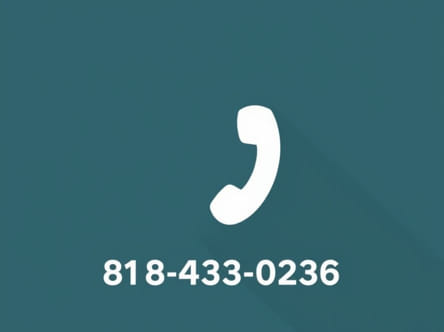

If you’re looking for the phone number for Fidelity 401(k) customer service, the main number for participants in employer-sponsored retirement plans is typically:

- 1-800-835-5097– For Fidelity 401(k) customer service (available Monday to Friday, 8: 30 a.m. to 8: 00 p.m. Eastern Time)

This number connects you to a Fidelity representative who can help you with most account-related questions, including balance inquiries, contribution changes, investment options, distribution requests, and plan-specific details. You will likely need your Social Security number or plan number to verify your identity before proceeding with personalized assistance.

Automated Services and 24/7 Access

Fidelity also offers automated phone support for basic tasks. This includes checking your balance, recent contributions, or transaction history. These services are generally available 24/7 through the same phone number, using voice recognition or keypad prompts.

Why You Might Need to Call Fidelity About Your 401(k)

Account Assistance

There are many reasons why a 401(k) participant might need to call Fidelity:

- To check your current account balance or review recent contributions

- To change how future contributions are allocated among investment options

- To request a loan or withdrawal (if your plan allows it)

- To initiate a rollover to an IRA or another 401(k) plan

- To update your personal information, such as address or contact details

Questions About Plan Features

Since every employer-sponsored 401(k) plan can have different features, calling Fidelity allows you to speak directly with someone who can explain the specific rules of your plan. This includes vesting schedules, employer matching contributions, eligibility requirements, and withdrawal rules.

Rollover and Distribution Support

Fidelity can guide you through the process of rolling over your 401(k) to another retirement account, such as a traditional or Roth IRA. They can also explain the tax implications and timing of required minimum distributions (RMDs) if you are approaching retirement age.

Alternative Ways to Reach Fidelity

Online Customer Support

If you prefer not to call, Fidelity provides a variety of online resources:

- Secure Messaging: Log in to your Fidelity account and use the message center to communicate with a representative.

- Live Chat: Available during business hours through the Fidelity website.

- Virtual Assistant: An AI-powered chat function available 24/7 for basic queries.

In-Person Assistance

Fidelity also operates Investor Centers throughout the United States. These offices offer personalized assistance and appointments with financial advisors. To find a local branch, you can use the Investor Center Locator tool on Fidelity’s official website.

What Information to Have Ready Before You Call

Account Verification Details

When calling the Fidelity 401(k) phone number, be prepared to verify your identity. You may need:

- Your Social Security number or account number

- Your employer’s name

- Access to your email or phone number on file for security codes

Questions or Tasks in Mind

To make your call more efficient, write down your questions or the specific action you want to take. Whether it’s adjusting your contribution amount, learning more about fund performance, or asking about tax forms, having a list will help you stay organized.

Tips for Navigating Fidelity’s Phone System

Using the Automated Menu

Fidelity’s phone system includes a voice-activated or touch-tone menu. To speed up your call:

- Speak clearly if using voice prompts

- Press numbers when prompted (e.g., ‘1’ for account info, ‘2’ for contributions)

- Say ‘representative’ if you want to talk to a live person

Best Times to Call

The Fidelity 401(k) customer service line is often busiest in the mornings and on Mondays. For shorter wait times, consider calling midweek and mid-afternoon. If you need quick answers, start with the online account portal first.

Frequently Asked Questions About Fidelity 401(k) Support

Can I request a 401(k) loan over the phone?

Yes, if your plan allows loans, you can call Fidelity to initiate the request. In many cases, you may be directed to log in to your online account to complete the application and review loan terms.

How can I get tax documents related to my 401(k)?

You can request copies of tax forms such as Form 1099-R by calling the Fidelity 401(k) phone number or downloading them from your online account during tax season.

What if I forgot my login information?

If you’re locked out or can’t remember your username or password, the representative can help reset your credentials after confirming your identity.

Can I change my beneficiaries over the phone?

In most cases, beneficiary changes must be made online for security and legal documentation purposes. However, Fidelity’s phone support can guide you through the process.

Having the correct phone number for Fidelity 401(k) support is an essential resource for managing your retirement savings. The number1-800-835-5097connects you with experts who can help you understand and optimize your retirement plan. Whether you’re checking a balance, making investment changes, requesting a withdrawal, or learning about your employer’s matching program, speaking with a Fidelity representative ensures clarity and confidence in your financial decisions. By staying informed and using all available resources including online tools and live support you can take full control of your retirement future with Fidelity.