When it comes to understanding the types of financial options available in the world of trading and investing, knowing the differences between European and Bermudan options is essential. These two styles of options differ primarily in their exercise terms, which can significantly affect the flexibility, pricing, and strategy associated with each. While both are used for hedging or speculative purposes, the timing of execution rights makes them suitable for different market needs. Investors, portfolio managers, and financial analysts often assess these differences when building risk management strategies or trading derivatives.

Definition and Basic Structure

European Option Explained

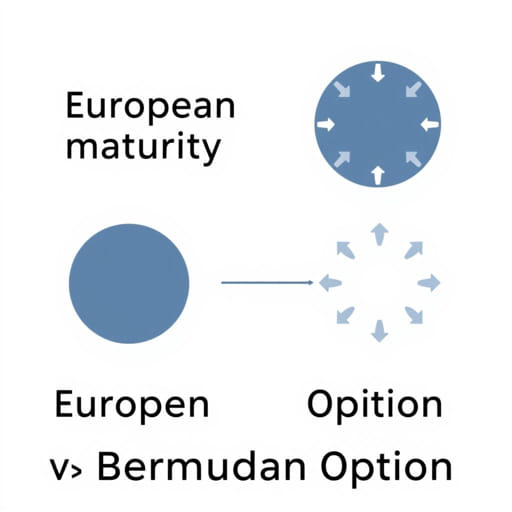

A European option is a type of options contract that can only be exercised on its expiration date. This means that the holder cannot choose to exercise the option at any point before maturity. It is commonly used in financial markets due to its simplicity and ease of valuation using standard pricing models such as the Black-Scholes model.

Bermudan Option Overview

A Bermudan option is more flexible than a European option. It allows the holder to exercise the option on specific predetermined dates between the purchase date and the expiration date. These dates are usually spaced out at regular intervals, such as monthly or quarterly. Bermudan options are often considered a hybrid between American and European options, offering more flexibility than European options but less than American ones.

Exercise Flexibility

One of the most important differences between European and Bermudan options is the degree of flexibility granted to the holder regarding the timing of exercise.

- European Option: Can only be exercised on the expiration date. No early exercise is allowed.

- Bermudan Option: Can be exercised on several fixed dates before expiration, providing more choices and strategic control.

This flexibility can influence investor behavior, especially in volatile markets. The ability to lock in gains or manage losses before the final expiry date can be valuable, depending on market conditions.

Valuation and Pricing Considerations

The valuation of options depends heavily on the freedom to exercise. Because Bermudan options allow for earlier exercise opportunities compared to European ones, they typically command higher premiums.

European Option Pricing

European options are easier to price and model because the exercise date is fixed. The Black-Scholes model is the most commonly used tool for pricing European options. The model considers the stock price, strike price, volatility, time to expiration, and interest rate to calculate the option’s value.

Bermudan Option Pricing

Pricing Bermudan options is more complex due to the multiple exercise dates. It usually involves numerical methods such as binomial trees or Monte Carlo simulations. These methods help account for the possible decisions at each potential exercise date and the impact of changing market conditions over time.

Market Use and Applications

Both types of options are used across different financial markets, but their applications vary based on the structure of the investment and the investor’s strategic objectives.

Where European Options Are Common

European options are frequently used in index options and are popular in the over-the-counter (OTC) markets. Their simplicity makes them suitable for institutional investors and funds looking for straightforward hedging or speculative tools.

Where Bermudan Options Are Applied

Bermudan options are often used in interest rate derivatives, credit default swaps, and structured products. They are particularly useful in corporate finance or bond management, where events occur on predictable schedules such as coupon dates or quarterly reports.

Risk Management Implications

The choice between European and Bermudan options can affect an investor’s risk management strategy. While both can be used for hedging, the differences in exercise rights lead to different approaches.

European Options for Long-Term Protection

Because European options only allow exercise at maturity, they are often used when the goal is to protect an investment over a specific timeframe without the need to adjust the hedge early. This can suit passive investors who anticipate longer-term changes in asset prices.

Bermudan Options for More Control

With more opportunities to exercise, Bermudan options give investors the ability to respond to intermediate market movements. This can be advantageous in uncertain environments or when managing complex portfolios that require more active risk control.

Cost and Liquidity Differences

The costs associated with each type of option can differ significantly due to their respective features.

- European Options: Generally less expensive due to limited exercise rights and simpler valuation. They are also more liquid, especially on organized exchanges.

- Bermudan Options: Typically cost more because of the added flexibility. They may also be less liquid, as they are often customized and traded over the counter.

Investors must weigh the cost of the option premium against the potential benefits of flexibility and control. For smaller investors or those who require a highly liquid market, European options may be more accessible.

Examples and Case Use

Example of a European Option

Suppose an investor buys a European call option on a stock index that expires in six months. No matter how the market behaves in the meantime, the investor can only exercise the option on the final day. If the index value is higher than the strike price at expiration, the investor profits. If not, the option expires worthless.

Example of a Bermudan Option

Imagine a Bermudan option on a corporate bond that allows the holder to exercise the option quarterly over a two-year period. If interest rates fall significantly after the first year, the holder may decide to exercise the option early to lock in a favorable return. This feature allows the investor to react strategically to market developments.

Which Option Is Better?

There is no universally better choice between European and Bermudan options. The decision depends on several factors, including investment goals, market outlook, and individual risk tolerance.

- Choose European optionsif you prefer lower costs, simplicity, and do not need early exercise.

- Choose Bermudan optionsif you want more flexibility and are willing to pay a premium for additional control.

Understanding how each option type aligns with your financial strategy is key to selecting the right product for your needs.

European and Bermudan options each serve unique roles in the financial markets. While European options offer simplicity and lower pricing, Bermudan options provide added flexibility and greater strategic value. Knowing how they differ and how they can fit into your portfolio empowers better decision-making in both hedging and trading. By evaluating the timing of exercise, cost structure, and market usage, investors can optimize their choices and align their strategies with their financial goals.